HMRC is the UK department tasked with overseeing the collection of taxes, ensuring compliance with tax laws, and managing other financial services, including government benefits and tax credits. It operates under the umbrella of the Treasury and plays a key role in implementing fiscal policies, preventing tax evasion, and supporting economic stability.

Key Features

- Tax Collection: HMRC is responsible for collecting various types of taxes, including income tax, corporation tax, VAT, and national insurance contributions.

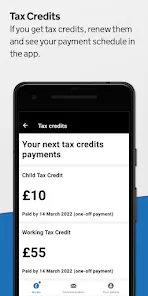

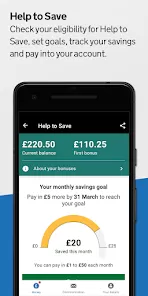

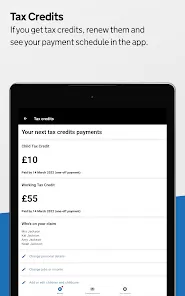

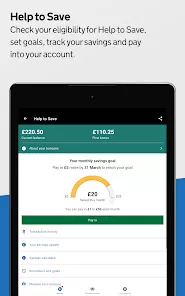

- Tax Credits and Benefits: The department administers financial support programs such as Universal Credit, Child Benefit, and Working Tax Credit, providing assistance to individuals and families.

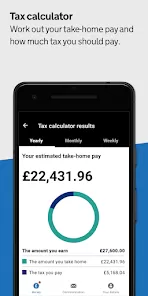

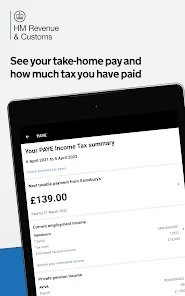

- Online Services: HMRC offers a range of online services for taxpayers, including digital tax filing, account management, and access to tax records.

- Compliance and Enforcement: The department enforces tax laws and regulations, conducting audits and investigations to ensure compliance and tackle tax evasion.

- Customer Support: HMRC provides support through various channels, including phone, email, and online resources, helping taxpayers with queries and issues.

- Educational Resources: The department offers guidance and resources to help individuals and businesses understand their tax obligations and manage their finances effectively.

Pros and Cons

Pros

- Comprehensive Tax Management: HMRC efficiently manages a wide range of tax responsibilities, ensuring proper collection and administration of taxes.

- Digital Access: The availability of online services allows taxpayers to manage their accounts, file returns, and access support conveniently from anywhere.

- Support for Individuals and Businesses: HMRC offers various support programs, including benefits and tax credits, to assist individuals and businesses in need.

- Robust Compliance Measures: The department’s enforcement actions help to maintain tax compliance and prevent evasion, contributing to fair taxation.

- Educational Resources: HMRC’s guidance and resources support taxpayers in understanding complex tax laws and making informed financial decisions.

Cons

- Complexity of Tax Regulations: The complexity of tax laws and regulations can be challenging for taxpayers to navigate, leading to confusion and potential errors.

- Customer Service Challenges: Some users report difficulties in reaching customer service or obtaining timely support, leading to frustration and delays.

- Administrative Errors: Occasionally, administrative errors may occur, impacting tax assessments or benefit payments and requiring resolution.

- Privacy Concerns: The handling of sensitive financial information raises privacy concerns, necessitating robust data protection measures.

- Technological Limitations: While online services are available, technical issues or system outages can disrupt access and functionality.

Functions

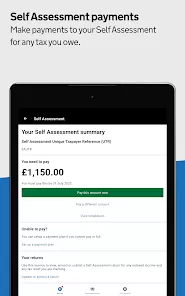

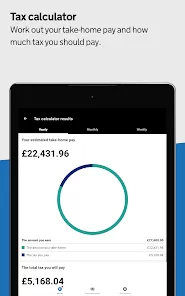

- Tax Filing and Payments: HMRC enables individuals and businesses to file tax returns and make payments online, streamlining the process of tax management.

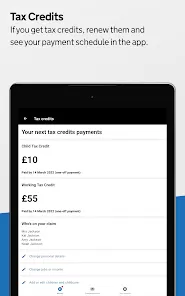

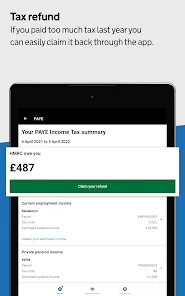

- Benefits Administration: The department manages and processes applications for various benefits and tax credits, providing financial support to eligible recipients.

- Compliance Checks: HMRC conducts audits and compliance checks to ensure that taxpayers adhere to tax laws and regulations.

- Debt Collection: The department handles the collection of unpaid taxes and other financial obligations, including the use of enforcement actions when necessary.

- Information and Guidance: HMRC provides extensive information and guidance on tax-related matters, helping taxpayers understand their obligations and rights.

How to Use the HMRC App

Getting Started

- Download and Install: Search for the HMRC app in your device’s app store (iOS or Android). Download and install the app to start accessing its features.

- Create an Account: Open the app and sign in using your Government Gateway credentials or create a new account if you do not have one.

- Set Up Your Profile: Enter necessary personal details and link your HMRC account to the app to enable access to your tax information and services.

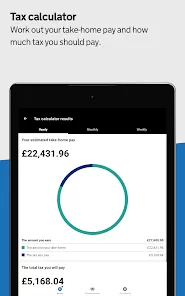

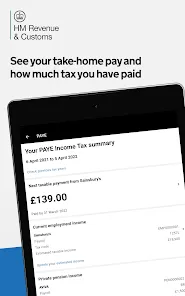

- Access Tax Information: Use the app to view your tax records, including your tax return status, payment history, and current tax liabilities.

- File Tax Returns: Navigate to the tax filing section to complete and submit your tax returns directly through the app, ensuring timely submission.

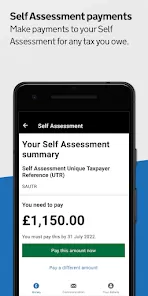

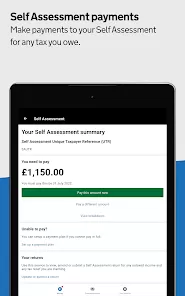

- Make Payments: The app allows you to make tax payments and manage your payment schedule, offering convenience in managing your financial obligations.

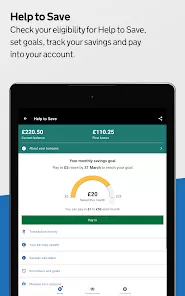

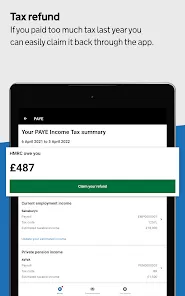

- Check Benefits and Credits: If you receive benefits or tax credits, use the app to check your eligibility, update your details, and track payments.

- Receive Notifications: Enable notifications to stay updated on important deadlines, payment reminders, and other relevant information.

- Access Help and Support: Use the app’s help and support features to find answers to common questions or contact customer service for assistance.

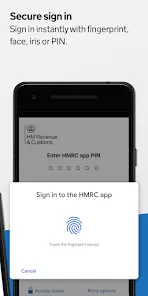

- Secure Your Account: Ensure that your account is secure by setting up strong passwords and using any available two-factor authentication options.

0

0