Lili Banking is a financial platform designed specifically for freelancers and small business owners. It offers a streamlined banking experience that integrates essential financial tools, allowing users to manage their finances efficiently. With no monthly fees and a user-friendly app, Lili aims to simplify banking for entrepreneurs, providing them with features tailored to their unique needs.

Features of Lili Banking

Lili Banking comes packed with features that make managing business finances easier. Some notable features include:

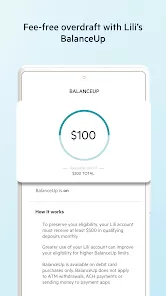

- No Monthly Fees: Lili provides a fee-free banking experience, allowing users to keep more of their earnings.

- Mobile Check Deposit: Users can deposit checks directly through the app, eliminating the need for physical bank visits.

- Expense Tracking: Automatically categorize expenses to help users keep track of their spending and manage budgets effectively.

- Tax Tools: Lili helps users set aside funds for taxes, making it easier to manage tax obligations and avoid surprises.

- Instant Notifications: Get real-time alerts for transactions, helping users stay informed about their financial activity.

Pros and Cons of Using Lili Banking

Pros

- User-Friendly Interface: The app is designed for ease of use, making it accessible for all skill levels.

- Integrated Financial Tools: Lili combines banking and financial management features in one platform, streamlining the user experience.

- Focus on Small Businesses: Tailored specifically for freelancers and entrepreneurs, it addresses their unique financial needs.

- Fast Account Setup: Users can quickly open an account and start managing their finances in minutes.

Cons

- Limited ATM Network: Users may face challenges finding ATMs without incurring fees, as Lili has a smaller network compared to traditional banks.

- Customer Service Availability: Some users have reported delays in response times for customer support inquiries.

- Limited Cash Deposit Options: Cash deposits may require trips to partner locations, which can be inconvenient for some users.

Functions of the Lili Banking App

The Lili app is equipped with various functions designed to make financial management straightforward. Key functions include:

- Account Management: View balances, recent transactions, and account statements all in one place.

- Expense Categorization: Automatically track and categorize expenses for better financial oversight.

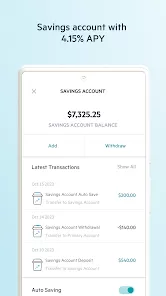

- Tax Saving Goals: Set aside a percentage of income for taxes to ensure you’re always prepared come tax season.

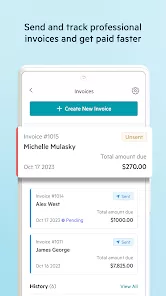

- Invoicing: Create and send invoices directly through the app, simplifying the billing process for freelancers.

- Budgeting Tools: Establish budgets for different categories to monitor spending and improve financial discipline.

How to Use the Lili Banking App

Getting started with Lili Banking is simple. Here’s a step-by-step guide:

- Download the App: Install the Lili Banking app from the Google Play Store or Apple App Store.

- Create an Account: Sign up using your email and follow the prompts to set up your account.

- Verify Your Identity: Complete the identity verification process, which may include providing personal information and documentation.

- Link Your Income Sources: Connect any payment methods or income sources to streamline fund deposits.

- Explore Features: Familiarize yourself with the app’s functionalities, including expense tracking and invoicing tools.

- Manage Your Finances: Begin using the app to track expenses, manage budgets, and set aside funds for taxes.

0

0